We can start the topic from the meaning and understanding of the term depreciation and appreciation:

Depreciation: A reduction in the value of an asset over time, or a decrease in the value of a currency relative to other currencies.

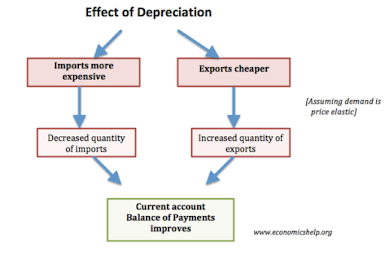

How depreciation affects current account:

We will understand this with the below points:

- If there is depreciation in the exchange rate then there will be a fall in the foreign price of the exports of that particular country. It will appear more competitive and therefore there will be a rise in the quantity of exports.

- Assuming demand for exports is relatively elastic then depreciation will lead to an increase in the value of exports and therefore improve the current account deficit.

- Similarly, a depreciation of the exchange rate will also lead to an increase in the cost of buying imports. All these will help to reduce current account deficit and fall in demand for imports.

- Therefore, in theory, a depreciation in the exchange rate should improve the current account

- An appreciation should worsen the current account.

Evaluation

However, there can be many reasons due to which it may not happen in practice:

The impact of depreciation depends on the elasticity of demand. The Marshall Lerner condition states that depreciation in the exchange rate will only improve current account – if combined PEDx and PEDm is greater than 1. For example, if UK exports’ demand is very inelastic. They depreciation will lead to only a very small increase in quantity demand.

Depreciation means exports can be cheaper. However, a UK firm could arrange to keep identical foreign worth and simply create a much bigger gross margin. This typically happens within the short term. Companies don’t modify costs to shoppers however have exchange rate movements absorbed in their own margins. This can be one of the reasons why a movement within the exchange rate often takes time to have an effect on this account.

The J Curve result states however depreciation will worsen accounting within the short term as a result of demand is inelastic, but, over time, demand becomes additional elastic and so this account improves following devaluation

During 2008-09, the depreciation in the GBP didn’t affect the British’s current account deficit. One reason was the sluggish global growth. There was little foreign demand for British exports despite the fall in price

A key determinant of this account is domestic payment. Once client payment is growing, countries are shopping for additional imports. In a very recession, with falling client payment, this account tends to boost (lower deficit). For example, in the examples below from 1989-92, the current account improved – despite the Sterling index remaining constant. The reason for this improvement was the recession of 1990-92 and holding in consumer spending.

Appreciation, in general terms, is an increase in the value of an asset over time or an increase in the value of a currency against other foreign currency. An appreciation makes exports more expensive and imports cheaper.

An example of an appreciation in the value of the Pound 2009 – 2012

- Jan 2009 If £1 = €1.1

- June 2012 £1 = €1.27

- In this case, we can say there was a 15% appreciation in the value of the Pound against the Euro – between Jan 2009 and June 2012.

Effects of an appreciation:

- Exports more expensive. The foreign worth of United Kingdom of Great Britain’s exports can increase – thus Europeans can realize British exports expensive. Thus with the next worth, we might expect to examine a fall within the amount of United Kingdom of Great Britain's exports.

- Imports are cheaper. United Kingdom of Great Britain customers can realize that £1 currently buys a larger amount of European merchandise. Therefore, with cheaper imports, we would expect to see an increase in the number of imports.

- Lower (X-M) with lower export demand and greater spending on imports, we would expect fall in domestic aggregate demand (AD), causing lower economic growth.

- Lower inflation. An appreciation tends to cause lower inflation because:

-Import prices are cheaper. The value of foreign merchandise ANd raw materials can fall when an appreciation, e.g. foreign oil can decrease, resulting in cheaper fuel costs.

-Lower AD leads to lower demand-pull inflation.

-With export prices more expensive, manufacturers have greater incentives to cut costs to try and remain competitive.

- Monetary policy. It’s potential that AN appreciation within the exchange rate could create the Central Bank, a lot of willing to chop interest rates

An appreciation reduces inflationary pressure so interest rates can be lower.

- Also higher interest rates would cause the currency to rise even more. If the Central Bank thought appreciation was too speedy, they'll cut rates to cut back the worth of the currency.

Impact of appreciation on AD/AS

Assuming demand is comparatively elastic, associate appreciation contributes to lower AD (or a slower growth of AD), resulting in lower inflation and lower economic process.

Impact of appreciation on the current account:

Assuming demand is comparatively elastic; we might expect associate appreciation to worsen the present account position. Exports are costlier, thus we have a tendency to get a fall in exports. Imports are cheaper so we have a tendency to see a rise in imports. This may cause a much bigger deficit on the current account.

However, the impact on the present account isn't certain:

- Appreciation can tend to reduce inflation. this may build any country’s merchandise a lot of competitive, resulting in stronger exports long term; so, this might facilitate improving current account.

- The impact on the current account depends on the elasticity of demand. If demand for imports and exports is inelastic, then the current account might even improve. Exports are costlier, however if demand is inelastic, there'll solely be a tiny or low fall in demand. The worth of exports can increase. If demand for exports is price elastic, there'll be a proportionately bigger fall in export demand, and there'll be a fall within the worth of exports.

- Usually within the short term, demand is inelastic, however over time people become a lot of costs sensitive and demand a lot of elastic. It conjointly depends on what merchandise you export. Some merchandise with very little competition is inelastic. China’s producing exports are more likely to be price sensitive as a result of there's a lot of competition.

Evaluating the effects of an appreciation- Elasticity. The impact of an appreciation depends upon the price elasticity of demand for exports and imports. The Marshall Lerner condition stations that an appreciation will worsen the current account if (PEDx + PEDm >1)

- Elasticity varies over time. In the short run, we often find demand for exports and imports are inelastic, so an appreciation improves current account. But, in due course of time, demand becomes more elastic as people switch to alternatives.

- The impact of an appreciation depends on the situation of the economy. If the economy is during a recession, then associate appreciation can cause a big fall in aggregate demand, and can in all probably contribute to higher unemployment. However, if the economy is during a boom, then associate appreciation can facilitate cut back inflationary pressures and limit the growth rate without too much adverse impact.

- It also depends on economic growth in other countries. If Europe was experiencing robust growth, they'd be a lot of probably to stay shopping for United Kingdom exports, even supposing they're costlier. However, in 2012, the EU economy was during a recession and thus was sensitive to the increased price of United Kingdom exports.

- It also depends on why the exchange rate is increasing in value. If there's an appreciation as a result of the economy is turning into a lot of competitive, then the appreciation won't be causing a loss of competitiveness. But, if there's an appreciation owing to speculation or weakness in different countries, then the appreciation might cause a much bigger loss of competitiveness.

How a change in currency does affects exports and imports?

Since the exchange rate has an effect on the trade surplus or deficit, a weaker domestic currency stimulates exports and makes imports expensive. Conversely, a powerful domestic currency hampers exports and makes imports cheaper.

For example an electronic element priced at $10 within the U.S. which will be exported to India. Assume the exchange rate is fifty rupees to the U.S. dollar. Ignoring shipping and alternative dealing prices like import duties for the instant, the $10 item would price the Indian businessperson five hundred rupees. Now, if the dollar strengthens against the Indian monetary unit to grade of fifty five, assuming that the U.S. businessperson leaves the $10 worth for the element unchanged, its worth would increase to 550 rupees ($10 x 55) for the Indian businessperson. this could force the Indian businessperson to see for cheaper elements from alternative locations. the ten appreciation within the dollar versus the rupee has thus diminished the U.S. exporter’s competitiveness within the Indian market.

To conclude, once a country has stronger price of currency or appreciation, they'll import a lot of product and services from another country (assuming that the currency of exporting country remains constant.) than what they used to. And reversely, if depreciation happens in a country, no matter what the reason is, the amount or the quantity of product that they used to buy will be lesser in the same amount of money.

Well done

ReplyDeleteThank you

DeleteGood work!!keep it up!!

ReplyDeleteGood work!!keep it up!!

ReplyDeleteI would like to share your blog with my friends. Nicely presented.

ReplyDeleteThank you 😊 so much

DeleteGood work!! Keep it up

ReplyDeleteThank you

DeleteGood read👍

ReplyDeleteThanks Pranika

DeleteGood

ReplyDeleteThank you

DeleteGood project 👍 All the best

ReplyDeleteThank you so much

Deleteconcept well explained..🙌

ReplyDeleteThank you

Deleteconcept well explained..🙌

ReplyDeleteNice work keep it up.

ReplyDeleteGood read

ReplyDeleteThank you

DeleteGreat one✌️

ReplyDeleteThanks Rudra

DeleteGreat

ReplyDeleteThank you Sarthak

DeleteWell done��

ReplyDeleteThank you

DeleteGreat write up.

ReplyDeleteThank you

DeleteGood concept👌

ReplyDeleteThank You

DeleteWell done!

ReplyDeleteThank you

DeleteExcellent work! Keep up!!👍

ReplyDeleteThank you

Delete